General

Advantages

Compare products

Special offer

Rocket Loan

Get a loan of up to 5 million AMD at a rocket speed, without any commission and income proof document. Apply with Idram&IDBank application or IDBanking.am platform, and get the loan directly in the application within 5 minutes.

Overdue interest, per day-0.1%

1) information presented for the loan is false or inaccurate,

2) obligations provided by the agreement failed to be performed,

3) other grounds, according to the agreement

2) Good Score,

3) enough cash flow

2. Negative credit history of the customer

3. Negative credit history of a person related to the customer

4. Insufficient income

5. Insufficient level of creditworthiness

6. Insufficient level of collateral liquidity from the Bank's point of view

7. An undesirable customer for the Bank

8. Providing false or unreliable information

9. Availability of information questioning the returnability of the loan

10. Lack of Customer Email

11. Other grounds

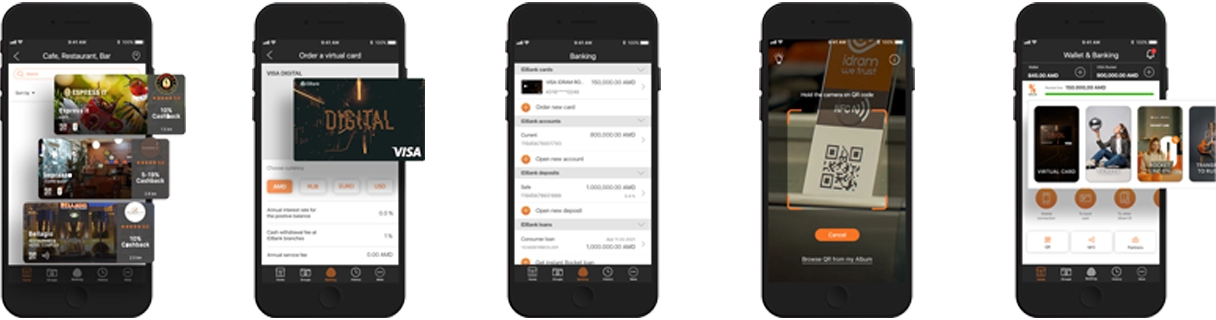

• Idram&IDBank mobile application

• Idram Internet Payment System

2. «Idram&IDBank» application

Overdue interest, per day-0.1%

1) information presented for the loan is false or inaccurate,

2) obligations provided by the agreement failed to be performed,

3) other grounds, according to the agreement

2) Good Score,

3) enough cash flow

2. Negative credit history of the customer

3. Negative credit history of a person related to the customer

4. Insufficient income

5. Insufficient level of creditworthiness

6. Insufficient level of collateral liquidity from the Bank's point of view

7. An undesirable customer for the Bank

8. Providing false or unreliable information

9. Availability of information questioning the returnability of the loan

10. Lack of Customer Email

11. Other grounds

• Idram&IDBank mobile application

• Idram Internet Payment System

Minimum aggregate balance of loan(s) to be consolidated/combined/deferred (principal amount + interest)-30.000

Requirements for loans subject to combination/payment deferment-Loans issued under the condition of payback "at the end of the term"

One-time fee established for the use of the type of loan-2% (maximum AMD 100,000)

Absence of any outstanding loan obligations as of the date of combination/deferment of payment

Absence of any bans imposed by CESA.

Absence of classified loan liabilities (assets) in commercial banks and credit organizations.

*-The condition of collecting a one-time fee for the utilization of the combination/deferment of repayment opportunity is effective as of 08.09.2024. The fee is calculated based on the minimum aggregate balance of the loan(s) to be combined/deferred.

2. «Idram&IDBank» application

Overdue interest, per day-0.1%

1) information presented for the loan is false or inaccurate,

2) obligations provided by the agreement failed to be performed,

3) other grounds, according to the agreement

2) Good Score,

3) enough cash flow

2. Negative credit history of the customer

3. Negative credit history of a person related to the customer

4. Insufficient income

5. Insufficient level of creditworthiness

6. Insufficient level of collateral liquidity from the Bank's point of view

7. An undesirable customer for the Bank

8. Providing false or unreliable information

9. Availability of information questioning the returnability of the loan

10. Lack of Customer Email

11. Other grounds

• Idram&IDBank mobile application

• Idram Internet Payment System

Minimum aggregate balance of loan(s) to be consolidated/combined/deferred (principal amount + interest)-30.000

Requirements for loans subject to combination/payment deferment-Loans issued under the condition of payback "at the end of the term"

One-time fee established for the use of the type of loan-2% (maximum AMD 100,000)

Absence of any outstanding loan obligations as of the date of combination/deferment of payment

Absence of any bans imposed by CESA.

Absence of classified loan liabilities (assets) in commercial banks and credit organizations.

*-The condition of collecting a one-time fee for the utilization of the combination/deferment of repayment opportunity is effective as of 08.09.2024. The fee is calculated based on the minimum aggregate balance of the loan(s) to be combined/deferred.

Details via abcfinance.am and acra.am links.

With Rocket Line 0%, there are no commissions or hidden fees, you only pay the amount of the product and not a penny more. Rocket Line 0% also allows you to reduce the interest rate on your real estate mortgage loan by up to 2 percentage if you use it in the amounts mentioned in the contract signed with you.

Before using, it is necessary to enable the corresponding function by clicking on the “Use the limit when paying” button. Payment can be made with Rocket Line if the amount to be paid is AMD 3000 or more. The limit can be used by choosing its repayment period from 1-60 months depending on the amount.

• In case of non-cash payments up to AMD 30 000, the maximum term of the loan is 6 months, in case of payments from AMD 30 000 to AMD 100 000 - 36 months, with a period of 9 to 36 months (9, 12, 15, 18, 21, 24, 27, 30, 33, 36 months) in case of receiving Rocket Line, the client will make the payments by annuity option.

• In case of payments over AMD 100 000, the maximum term is 60 months, with a term of 9 to 60 months (1, 2, 3, 6, 9, 12, 15, 18, 21, 24, 27, 30, 33, 36, 39, 42, 45, 48, 51, 54, 57, 60 months) in case of receiving Rocket Line, the client will make the payments by annuity option.

• In the case of loans with a term of up to 6 months inclusive, the loan is repaid at the end of the term, and for loans with a term of 9 to 60 months, an annuity repayment method is defined.

“Rocket line” loan/credit limit and combination/deferment of repayment of “Rocket line” loans information bulletin

“Rocket line” loan/credit limit and combination/deferment of repayment of “Rocket line” loans information bulletin