General

Advantages

Compare products

Rocket Line

Get or increase your limit without visiting the bank

There is no need to submit any documents or conclude an agreement

The loan is provided without any commissions

Rocket loans/credit lines

Rocket online loan

Credit Lines

The loan is being approved within a few minutes

The loan is available in Armenian drams

The loan is provided without any commissions

Loan approval takes up to 5 minutes

You should apply online to get the limit without visiting the Bank and without any documentation

There is no need to submit any documents

The loan is provided without any commissions

Use the amount free of interest up to the 15th day of the following month.

Maximum loan amount is 10 000 000 AMD

Interest rate is lower than for the other credit lines - 15-16 % only

The loan is provided without any commissions

Special offer

Rocket Loan

Get a loan of up to 5 million AMD at a rocket speed, without any commission and income proof document. Apply with Idram&IDBank application or IDBanking.am platform, and get the loan directly in the application within 5 minutes.

Type of loan

Credit

Purpose

Consumer, for making non-cash payment

Currency

AMD

Minimum limit amount

10,000

Maximum limit amount

10,000,000

Minimum loan amount provided within the limit

3,000

Maximum loan amount provided within the limit

10,000,000

Annual nominal interest rate

0% - 21.7%

Annual actual interest rate

0% - 24%

Minimum loan maturity

1 month

Maximum loan maturity

60 months

Method of disbursement

Non-cash – through the customer’s current account: 1. Online platforms of «IDBanking» and «Idram Internet Payment System», 2. «Idram&IDBank» application

Loan and interest repayment method

At the maturity/Annuity

Loan application review fee

Not specified

Loan disbursement lump up fee

Not specified

Loan account service fee

Not specified

Opening of current account

Not specified

Insurance

Not specified

Requirements to the borrower

Status-RA citizen physical person

Age eligibility

The borrower/guarantor should be 21 at least as of the date of application, and maximum 70 by the maturity date

Fine, penalty

Overdue loans, per day-0.1%

Overdue interest, per day-0.1%

Overdue interest, per day-0.1%

Early repayment fee

Not specified

Grounds, on which the Bank may require early repayment of the loan

The Bank may require early repayment of the loan, if:

1) information presented for the loan is false or inaccurate,

2) obligations provided by the agreement failed to be performed,

3) other grounds, according to the agreement

1) information presented for the loan is false or inaccurate,

2) obligations provided by the agreement failed to be performed,

3) other grounds, according to the agreement

Positive factors for provision of the loan

1) Good credit history,

2) Good Score,

3) enough cash flow

2) Good Score,

3) enough cash flow

Rejection factors

1. Non-compliance with the terms of the loan

2. Negative credit history of the customer

3. Negative credit history of a person related to the customer

4. Insufficient income

5. Insufficient level of creditworthiness

6. Insufficient level of collateral liquidity from the Bank's point of view

7. An undesirable customer for the Bank

8. Providing false or unreliable information

9. Availability of information questioning the returnability of the loan

10. Lack of Customer Email

11. Other grounds

2. Negative credit history of the customer

3. Negative credit history of a person related to the customer

4. Insufficient income

5. Insufficient level of creditworthiness

6. Insufficient level of collateral liquidity from the Bank's point of view

7. An undesirable customer for the Bank

8. Providing false or unreliable information

9. Availability of information questioning the returnability of the loan

10. Lack of Customer Email

11. Other grounds

Maximum decision-making term

5 minutes

Customer notification maximum term (on the decision made with respect to the loan)

5 minutes

Venue where applications are accepted, processed and loan is provided

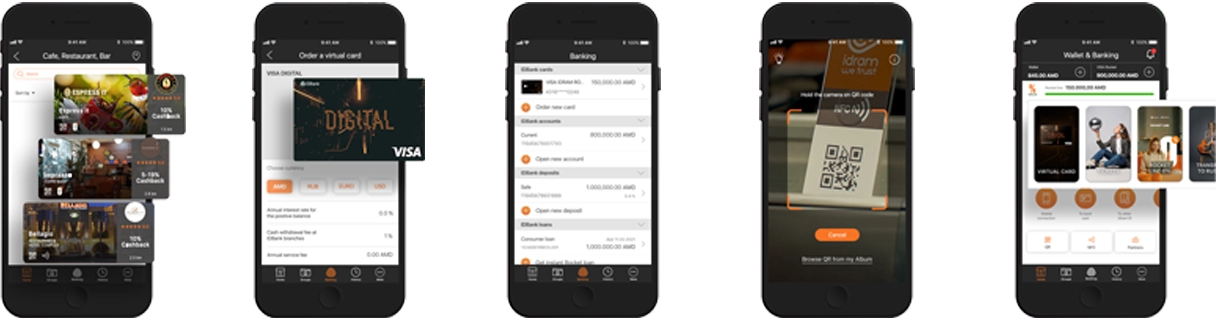

• IDBanking.am online platform

• Idram&IDBank mobile application

• Idram Internet Payment System

• Idram&IDBank mobile application

• Idram Internet Payment System

Maximum validity term of decision

1 working day

Type of loan

Credit

Purpose

Consumer loan for combining “Rocket Line” loans

Currency

AMD

Minimum limit amount

Not applicable

Maximum limit amount

10,000,000

Minimum loan amount provided within the limit

30,000

Maximum loan amount provided within the limit

10,000,000

Annual nominal interest rate

21.7%

Annual actual interest rate

24%

Minimum loan maturity

9 months

Maximum loan maturity

60 months

Method of disbursement

Non-cash – through the customer’s current account: 1. Online platforms of «IDBanking» and «Idram Internet Payment System»,

2. «Idram&IDBank» application

2. «Idram&IDBank» application

Loan and interest repayment method

Annuity

Loan application review fee

Not specified

Loan disbursement lump up fee

Not specified

Loan account service fee

Not specified

Opening of current account

Not specified

Insurance

Not specified

Requirements to the borrower

Status-RA citizen physical person

Age eligibility

The borrower/guarantor should be 21 at least as of the date of application, and maximum 70 by the maturity date

Fine, penalty

Overdue loans, per day-0.1%

Overdue interest, per day-0.1%

Overdue interest, per day-0.1%

Early repayment fee

Not specified

Grounds, on which the Bank may require early repayment of the loan

The Bank may require early repayment of the loan, if:

1) information presented for the loan is false or inaccurate,

2) obligations provided by the agreement failed to be performed,

3) other grounds, according to the agreement

1) information presented for the loan is false or inaccurate,

2) obligations provided by the agreement failed to be performed,

3) other grounds, according to the agreement

Positive factors for provision of the loan

1) Good credit history,

2) Good Score,

3) enough cash flow

2) Good Score,

3) enough cash flow

Rejection factors

1. Non-compliance with the terms of the loan

2. Negative credit history of the customer

3. Negative credit history of a person related to the customer

4. Insufficient income

5. Insufficient level of creditworthiness

6. Insufficient level of collateral liquidity from the Bank's point of view

7. An undesirable customer for the Bank

8. Providing false or unreliable information

9. Availability of information questioning the returnability of the loan

10. Lack of Customer Email

11. Other grounds

2. Negative credit history of the customer

3. Negative credit history of a person related to the customer

4. Insufficient income

5. Insufficient level of creditworthiness

6. Insufficient level of collateral liquidity from the Bank's point of view

7. An undesirable customer for the Bank

8. Providing false or unreliable information

9. Availability of information questioning the returnability of the loan

10. Lack of Customer Email

11. Other grounds

Maximum decision-making term

5 minutes

Customer notification maximum term (on the decision made with respect to the loan)

5 minutes

Venue where applications are accepted, processed and loan is provided

• IDBanking.am online platform

• Idram&IDBank mobile application

• Idram Internet Payment System

• Idram&IDBank mobile application

• Idram Internet Payment System

Maximum validity term of decision

1 working day

Prerequisites for the use of a combination loan

Number of existing "Rocket Line" loans subject to combination/ deferment of repayment (when performing one transaction)/-from 2 to 20 loans

Minimum aggregate balance of loan(s) to be consolidated/combined/deferred (principal amount + interest)-30.000

Requirements for loans subject to combination/payment deferment-Loans issued under the condition of payback "at the end of the term"

One-time fee established for the use of the type of loan-2% (maximum AMD 100,000)

Absence of any outstanding loan obligations as of the date of combination/deferment of payment

Absence of any bans imposed by CESA.

Absence of classified loan liabilities (assets) in commercial banks and credit organizations.

*-The condition of collecting a one-time fee for the utilization of the combination/deferment of repayment opportunity is effective as of 08.09.2024. The fee is calculated based on the minimum aggregate balance of the loan(s) to be combined/deferred.

Minimum aggregate balance of loan(s) to be consolidated/combined/deferred (principal amount + interest)-30.000

Requirements for loans subject to combination/payment deferment-Loans issued under the condition of payback "at the end of the term"

One-time fee established for the use of the type of loan-2% (maximum AMD 100,000)

Absence of any outstanding loan obligations as of the date of combination/deferment of payment

Absence of any bans imposed by CESA.

Absence of classified loan liabilities (assets) in commercial banks and credit organizations.

*-The condition of collecting a one-time fee for the utilization of the combination/deferment of repayment opportunity is effective as of 08.09.2024. The fee is calculated based on the minimum aggregate balance of the loan(s) to be combined/deferred.

Type of loan

Credit

Purpose

Consumer loan for deferment of repayment of “Rocket Line” loans

Currency

AMD

Minimum limit amount

Not applicable

Maximum limit amount

10,000,000

Minimum loan amount provided within the limit

30,000

Maximum loan amount provided within the limit

10,000,000

Annual nominal interest rate

21.7%

Annual actual interest rate

24%

Minimum loan maturity

9 months

Maximum loan maturity

60 months

Method of disbursement

Non-cash – through the customer’s current account: 1. Online platforms of «IDBanking» and «Idram Internet Payment System»,

2. «Idram&IDBank» application

2. «Idram&IDBank» application

Loan and interest repayment method

Annuity

Loan application review fee

Not specified

Loan disbursement lump up fee

Not specified

Loan account service fee

Not specified

Opening of current account

Not specified

Insurance

Not specified

Requirements to the borrower

Status-RA citizen physical person

Age eligibility

The borrower/guarantor should be 21 at least as of the date of application, and maximum 70 by the maturity date

Fine, penalty

Overdue loans, per day-0.1%

Overdue interest, per day-0.1%

Overdue interest, per day-0.1%

Early repayment fee

Not specified

Grounds, on which the Bank may require early repayment of the loan

The Bank may require early repayment of the loan, if:

1) information presented for the loan is false or inaccurate,

2) obligations provided by the agreement failed to be performed,

3) other grounds, according to the agreement

1) information presented for the loan is false or inaccurate,

2) obligations provided by the agreement failed to be performed,

3) other grounds, according to the agreement

Positive factors for provision of the loan

1) Good credit history,

2) Good Score,

3) enough cash flow

2) Good Score,

3) enough cash flow

Rejection factors

1. Non-compliance with the terms of the loan

2. Negative credit history of the customer

3. Negative credit history of a person related to the customer

4. Insufficient income

5. Insufficient level of creditworthiness

6. Insufficient level of collateral liquidity from the Bank's point of view

7. An undesirable customer for the Bank

8. Providing false or unreliable information

9. Availability of information questioning the returnability of the loan

10. Lack of Customer Email

11. Other grounds

2. Negative credit history of the customer

3. Negative credit history of a person related to the customer

4. Insufficient income

5. Insufficient level of creditworthiness

6. Insufficient level of collateral liquidity from the Bank's point of view

7. An undesirable customer for the Bank

8. Providing false or unreliable information

9. Availability of information questioning the returnability of the loan

10. Lack of Customer Email

11. Other grounds

Maximum decision-making term

5 minutes

Customer notification maximum term (on the decision made with respect to the loan)

5 minutes

Venue where applications are accepted, processed and loan is provided

• IDBanking.am online platform

• Idram&IDBank mobile application

• Idram Internet Payment System

• Idram&IDBank mobile application

• Idram Internet Payment System

Maximum validity term of decision

1 working day

Prerequisites for the use of a loan for deferment of repayment

Number of existing "Rocket Line" loans subject to combination/ deferment of repayment (when performing one transaction)/- 1 loan

Minimum aggregate balance of loan(s) to be consolidated/combined/deferred (principal amount + interest)-30.000

Requirements for loans subject to combination/payment deferment-Loans issued under the condition of payback "at the end of the term"

One-time fee established for the use of the type of loan-2% (maximum AMD 100,000)

Absence of any outstanding loan obligations as of the date of combination/deferment of payment

Absence of any bans imposed by CESA.

Absence of classified loan liabilities (assets) in commercial banks and credit organizations.

*-The condition of collecting a one-time fee for the utilization of the combination/deferment of repayment opportunity is effective as of 08.09.2024. The fee is calculated based on the minimum aggregate balance of the loan(s) to be combined/deferred.

Minimum aggregate balance of loan(s) to be consolidated/combined/deferred (principal amount + interest)-30.000

Requirements for loans subject to combination/payment deferment-Loans issued under the condition of payback "at the end of the term"

One-time fee established for the use of the type of loan-2% (maximum AMD 100,000)

Absence of any outstanding loan obligations as of the date of combination/deferment of payment

Absence of any bans imposed by CESA.

Absence of classified loan liabilities (assets) in commercial banks and credit organizations.

*-The condition of collecting a one-time fee for the utilization of the combination/deferment of repayment opportunity is effective as of 08.09.2024. The fee is calculated based on the minimum aggregate balance of the loan(s) to be combined/deferred.

Information regarding credit history and credit score

You can learn about the importance of credit history and credit score here․

Details via abcfinance.am and acra.am links.

Details via abcfinance.am and acra.am links.

Rocket Line operates in more than 8,300 outlets, and in a number of outlets there is also the opportunity to make Rocket Line purchases at 0%. You can buy any goods with Rocket line, pay in 1 or 36 months, depending on the terms of the given trade and service point.

You can buy any goods with Rocket line, pay in 1-36 months, depending on the terms of the given trade and service point. There are no commissions and hidden fees for Rocket Line 0%, you only pay just for what you bought and nothing ahead. Rocket Line 0% also allows you to reduce your real estate secured loan interest rate by up to 2 percentage points, if you use it in the amount stipulated in the contract signed with you.

Rocket Line limit is provided if you are an Idram&IDBank application Premium Plus user and a customer of IDBank. In that case, the Bank can set a minimum limit for you, starting from 10,000 AMD. Moreover, the credit history of the customer is not verified, there is no need to apply to the Bank either. The limit will appear automatically on the first page of your Idram&IDBank application. You can use the limit as needed; no interest shall accrue on the unused amount.

The limit of the Rocket line is from 10,000 to 10 million AMD, depending on the customer’s loyalty and credit history. In order to increase the limit, the customer can apply to the Bank from Idram&IDBank application or IDBanking.am online platform, give ACRA consent, and according to his credit score the Bank will either provide a higher limit, leave the limit unchanged, or refuse to provide the limit.

First, you need to activate the corresponding function by clicking on the “Use limit when paying” button. Payment with Rocket Line can be made in case the amount to be paid is 3000 AMD and more. The limit can be used by choosing its repayment period from 1 to 36 months.

Yes, the opportunity of making payments from the limit can be turned off or on by clicking on the green line of the Rocket Line limit on the first page of the Idram&IDBank application, using the “Use limit when paying” button.

Information about the used limit can be found in the “Banking” section of the Idram&IDBank application, under Rocket Line loans or simply by clicking on the green line of the Rocket Line limit on the first page of the Idram& IDBank application.

Used limits can be repaid during the time period of 1-36 months as chosen by you, by making payment at any time convenient for you. The Rocket Line limit differs from ordinary loans in the absence of a mandatory payment schedule.

Yes, it is; just in addition to the principal amount you need to pay the interest accrued as of the settlement date, and in case of prepaid interest, the Bank will return it to the customer’s bank account at the end of the operational day.

Yes, the limit can be reset if the customer violates the payment terms, does not fulfil its other loan obligations to the Bank, appears in the black list, etc.

Yes, the limit can be renewed once you have used the limit or part of it, and made payments within the period of your choice.

You can pay for more than 450 integrated services in the Idram&IDBank application, as well as when making QR or NFC payments at more than 19,000 outlets with Idram partners.

Rocket Line limit is provided to Idram Premium plus customers. However, in order to use it, it is necessary to become a customer of the Bank, to go through identification, to synchronize the accounts.

No, the limit is provided when you are a customer of both Idram and IDBank, i.e. you are a user of a joint platform of the two companies. You do not need to visit the Bank to become a customer of the Bank. From the Idram&IDBank application you can directly pass remote identification, become a customer of the Bank and use the Rocket line limit and all other services and benefits of the platform.

You can get Rocket Line for at least 1, 2, 3 months, and the maximum terms are determined depending on the amount of Rocket Line.

• For non-cash payments up to 30,000 drams, the maximum installment period is 6 months, for payments from 30,000 to 500,000 drams - 24 months, with a period of 9 to 24 months (9, 12, 15, 18, 21, 24 months) in case receiving Rocket line, the client will make payments under the annuity option.

• For payments over AMD 500,000, the maximum term is 36 months, and for a term of 9 to 36 months (with terms of 9, 12, 15, 18, 21, 24, 27, 30, 33, 36 months ), while in order to receive Rocket line, the client will make payments according to the annuity option.

• For non-cash payments up to 30,000 drams, the maximum installment period is 6 months, for payments from 30,000 to 500,000 drams - 24 months, with a period of 9 to 24 months (9, 12, 15, 18, 21, 24 months) in case receiving Rocket line, the client will make payments under the annuity option.

• For payments over AMD 500,000, the maximum term is 36 months, and for a term of 9 to 36 months (with terms of 9, 12, 15, 18, 21, 24, 27, 30, 33, 36 months ), while in order to receive Rocket line, the client will make payments according to the annuity option.

No, the term is specified at the issuance stage and cannot be changed later.

In the case of partners with the possibility of Rocket line 0%, the interest rate changes, and in other points it is 21.7% for all terms.

When paying with the annuity option, the client will make equal repayments.

The interest rate of digital installment is different for merchants, depending on whether the Rocket Line merchant offers 0% and for what period.

Yes, the repayment schedule is provided along with the digital installment agreement.

“Rocket line” loan/credit limit and combination/deferment of repayment of “Rocket line” loans information bulletin

“Rocket line” loan/credit limit and combination/deferment of repayment of “Rocket line” loans information bulletin