Tariffs

Advantages

Special offer

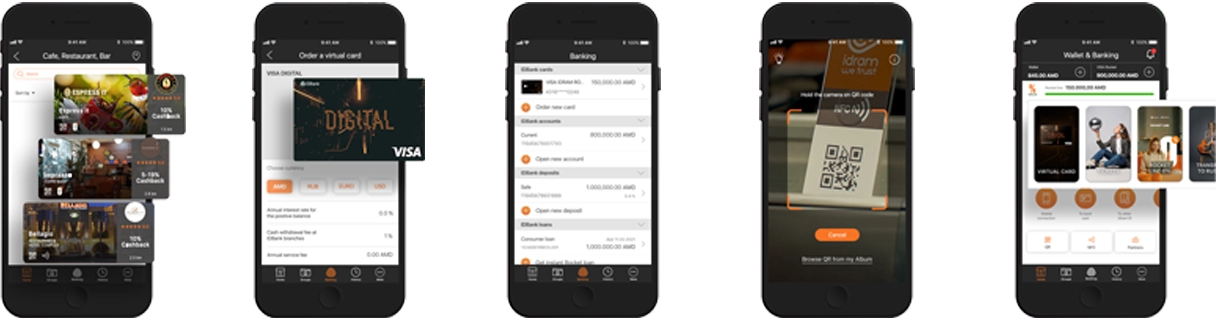

" Non-cash is profitable with Idram Rocket Visa. Get 0․5-1% cashback when making non-cash payments. The card is provided free of charge, without an annual service fee. In case of ordering from Idram&IDBank application and IDBanking.am platform, the card is delivered for free."

TARIFF

AMD

Account opening: Current account for physical entities In branches of the Bank and in the case of opening accounts of remote authenticated customers

Free

Account opening: In case of non-resident customers of the Republic of Armenia in case of opening an account in the Bank branches or opening accounts of customers (including savings accounts) that have undergone remote identification

In case of the first account - 10 000 AMD, the next accounts according to point 1.1.1.1

Account opening: Current account for physical entities In case of online opening

free of charge

Account opening: Current account for physical entities One account in the currency of the deposit placed and one account in AMD in case of placement of a deposit

free of charge

Account opening: Current account for physical entities One account in the currency of the transferred amount in case of transfer in the currency defined in paragraph 2.3

free of charge

Account reopening:

According to paragraph 1.1

Account reopening: For physical entities

According to paragraph 1.1

Annual/monthly account service fee (including saving accounts): For RA resident physical entities

free of charge

Annual/monthly account service fee (including saving accounts): For non-resident physical entities

AMD 1,000 monthly or AMD 12,000 yearly

Annual/monthly account service fee (including saving accounts):Annual commission fee applicable to an inactive account in case of non-implementation of any transaction on all accounts of the customer in the bank within one year (hereinafter - inactive accounts)

AMD 5,000

Account closing:

free of charge

Non-decreasing account balance:

Not specified

Cash deposit to accounts: For currency in cash accepted and quoted by the Bank

Cash deposit to accounts: Cash deposit to the account with a nominal value of 500 euros

Cash deposit to accounts: Cash deposit of up to 50,000 AMD

Cash deposit to accounts: Cash deposit of more than 50,000 AMD

Deposit and/or conversion of 5, 10, 20, 50 USD banknotes of 1996-2003 issue (inclusive) and 100 USD banknotes of 1996-2006 issue (inclusive)

Cash withdrawal/provision from the account:Within the limits of the amount deposited in cash and non-cash to the Client's accounts and the Bank's transit accounts, in AMD or in a foreign currency accepted in cash and quoted by the Bank

Cash withdrawal/provision from the account: In case of cash funds credited to the client’s accounts, and funds credited to the Bank’s transit accounts

According to the tariff set by the Bank for the given day

Cash withdrawal/provision from the account: In case of cash funds credited to the client’s accounts, and funds credited to the Bank’s transit accounts From account opened for regular payment

free of charge

Provision of electronic statements and payment documents

free of charge

Provision of statements (per 1 account): First time provision – for statements prescribed by RA legislation (provided at least once every 30 days)

free of charge

Provision of statements (per 1 account): More than once – in case of statements provided for a term of up to 1 year

500

Provision of statements (per 1 account): More than once – for statements provided for a term of more than 1 year

1,000

Provision of documents and agreements (per 1 document):For each transaction

free of charge

Provision of documents and agreements (per 1 document):For documents provided for a term of up to 1 year

2,000

Provision of documents and agreements (per 1 document):For documents provided for a term longer than 1 year

5,000

Provision of references on presence, balance, movement of AMD and/or foreign currency account according to the application: In Armenian

3,000

Provision of references on presence, balance, movement of AMD and/or foreign currency account according to the application: Bilingual (e.g. Armenian – Russian or Armenian – English)

5,000

Provision of references on presence, balance, movement of AMD and/or foreign currency account according to the application: Issuing of references

1,000

Issuing of references (including the provision of references to non-account holders)

5,000

Implementation of functions of service offices of public authorities (types of functions are available through the link:)

0-2,000 – depending on transaction type

Annual interest rate for current bank accounts

0% (annual percentage yield equals to 0%)

TARIFF

AMD

Transfers on the RA territory through bank account: Transfers (through IDBank system) between the clients of “ID Bank” CJSC in AMD and other currency

Free of charge

Transfers on the RA territory through bank account: Transfers to other Banks of RA and the state budget of RA in AMD

AMD 500 – when implemented on the premises of the branch, free of charge – when using online platforms

Transfers on the RA territory through bank account: Urgent transfers in AMD on the RA territory through bank account to other banks

0.1%,Minimum 500, maximum 10,000

Transfers on the RA territory through bank account: Transfers to other banks of RA in USD and Euro In case of submitting the payment order on paper

0.12%, minimum 2,000, maximum 20,000

Transfers on the RA territory through bank account: Transfers to other banks of RA in USD and Euro In case of submitting the payment order via Bank-Client/IDBANKING system

0.1%, minimum 1,500, maximum 20,000

Transfers in AMD on the RA territory without a bank account

1,500

Transfers in foreign currency, Transfers through bank account(USD, Euro): OUR variant. The transaction costs are borne by the client making the transfer

0.15%, Minimum 7,000, maximum 50,000

Transfers in foreign currency, Transfers through bank account(USD, Euro): OUR vartiant for non-resident physical entities: The transaction costs are borne by the client making the transfer

0.3%, Minimum 30,000

Transfers in foreign currency, Transfers through bank account(USD, Euro): Guaranteed OUR variant. In case of selecting this variant, the beneficiary will receive the whole amount

a. In case of USD – in addition to paragraph 2.3.1.1 the following charges apply:

12,000

b. up to 12,500 EUR inclusive 12,000

c. over 12,500 EUR 0.15%, Minimum 14,000, maximum 50,000

12,000

b. up to 12,500 EUR inclusive 12,000

c. over 12,500 EUR 0.15%, Minimum 14,000, maximum 50,000

Transfers in foreign currency, Transfers through bank account(USD, Euro): BEN/SHA variant. Transaction costs of third banks are charged from the money transferred

5,000

Transfers in foreign currency, Transfers through bank account(Rubles, Lari): Performed only with OUR variant, moreover, the beneficiary will receive the whole amount

0.1%, Minimum 3,000, maximum 30,000

Transfers in foreign currency, Transfers through bank account(Rubles, Lari): Performed only with OUR vartiant for non-resident physical entities, moreover, the beneficiary will receive the whole amount

0.3%, Minimum 30,000

Transfers in foreign currency, Transfers through bank account(In other currencies acceptable for the Bank): OUR variant. The transaction costs are borne by the client making the transfer

0.15%, Minimum 14,000, maximum 60,000

Transfers in foreign currency, Transfers through bank account(In other currencies acceptable for the Bank): OUR variant. The transaction costs are borne by the client making the transfer

0.3%, Minimum 30,000

Execution of the order on recalling the payment order or changing payment requisites according to the client’s application, making inquiries In AMD

1,000

Execution of the order on recalling the payment order or changing payment requisites according to the client’s application, making inquiries In rubles, lari

10,000

Execution of the order on recalling the payment order or changing payment requisites according to the client’s application, making inquiries:Adjustment/correction of an incorrectly executed transaction by the client

1,000

Execution of the order on recalling the payment order or changing payment requisites according to the client’s application, making inquiries(In other currency): In case of up to 1-year old payment orders

30,000

Execution of the order on recalling the payment order or changing payment requisites according to the client’s application, making inquiries(In other currency): In case of payment orders more than 1 year old

125,000

Return of transfer by the correspondent bank as a result of submission of incomplete or incorrect details by the client: In AMD

Free of charge

Return of transfer by the correspondent bank as a result of submission of incomplete or incorrect details by the client: In Rubles, Lari

10,000

Return of transfer by the correspondent bank as a result of submission of incomplete or incorrect details by the client: In other currency

20,000

Provision of copies of SWIFT messages

3,000

Return of unclear amounts received in foreign currency according to internal acts or at the request of the transferring bank: In rubles

Free of charge

Return of unclear amounts received in foreign currency according to internal acts or at the request of the transferring bank In other currency: Up to 500 USD or equivalent in other currency

5,000

Return of unclear amounts received in foreign currency according to internal acts or at the request of the transferring bank In other currency: 500 USD and over or equivalent in other currency

15,000

TARIFF

AMD

Purchase and sale, exchange of foreign currency in cash: In case of banknotes fit for circulation

According to exchange rate defined by the Bank for quoted foreign currencies in cash as of the given day

Purchase and sale, exchange of foreign currency in cash: Purchase of a banknote with a nominal value of 500 euros

1%

Purchase and sale, exchange of foreign currency in cash: In case of worn-out USD, EUR, RUB banknotes

3%

Cash foreign currency calculation, authentication, exchange with another banknote of nominal value: In case of up to 300 USD or 300 EUR or 20,000 RUB inclusive or another 300 USD equivalent foreign currency accepted in cash and quoted by the Bank

free of charge

Cash foreign currency calculation, authentication, exchange with another banknote of nominal value: In case of foreign currency over 300 USD or 300 EUR or 20,000 RUB or another equivalent foreign currency over 300 USD acceptable for the Bank

0.1%, minimum 1,000, maximum 100,000

AMD coins calculation, provision, exchange, packaging for non-client physical and legal entities of the Bank: Up to 50 of each coin

free of charge

AMD coins calculation, provision, exchange, packaging for non-client physical and legal entities of the Bank: Over 50 of each coin

1% of the amount, minimum 1,000 AMD

Cash withdrawal through the Bank’s POS-terminals with cards issued outside the RA territory

Provision of cash through the Bank’s POS-terminals with cards issued outside the RA territory

According to the tariff set by the Bank for the given day1

TARIFF

AMD

Intrabank conversions

According to the agreement or the Bank’s exchange rate

TARIFF

AMD

Connection to IDBANKING system

free of charge

TARIFF

AMD

Size (cm)

8.5x30x50

Up to 7 days (per day)

1,000

7 days

5,000

8 -14 days

7,000

15 – 30 days

10,000

31 – 90 days

15,000

91 – 180 days

20,000

181 – 270 days

25,000

271 – 365 days

30,000

366 – 456 days

35,000

457 – 730 days

50,000

Size (cm)

17x30x50

Up to 7 days (per day)

1,500

7 days

7,000

8 -14 days

10,000

15 – 30 days

15,000

31 – 90 days

20,000

91 – 180 days

30,000

181 – 270 days

35,000

271 – 365 days

40,000

366 – 456 days

45,000

457 – 730 days

55,000

Size (cm)

17x61x50

Up to 7 days (per day)

2,000

7 days

10,000

8 -14 days

13,000

15 – 30 days

20,000

31 – 90 days

30,000

91 – 180 days

35,000

181 – 270 days

40,000

271 – 365 days

50,000

366 – 456 days

50,000

457 – 730 days

60,000

Penalty in case of damage to the depository, deposit box, lock or seal, loss of key and provision of a copy

5,000 AMD per each case

Penalty in case of failure to free the deposit box and hand in the key

1,000 per day

TARIFF

AMD

Provision of permission for registration of a physical entity at the address of the pledged real estate property (irrespective of the number of entities to be registered)

3,000 per case

Provision of permission to make changes in the ownership certificate of the pledged property except for changes resulting from recognition of inheritance

10,000

Provision of permission to rent the pledged real estate or moveable property

10,000

Provision of permission to change the registration number of the pledged vehicle

5,000

Provision of permission to partially release the pledged property or change the pledged property (in case of physical entity clients, except for gold pledged loan borrowers)

10,000

Provision of permission to partially release the pledged property or change the pledged property (in case of legal entity, PE clients), except for loans pledged by gold, cash and bonds issued by the Bank as well as cases, when the subject of pledge is replaced by:

30,000 for change of each pledge agreement

Pledge of gold items or standardized gold bars

free of charge

Pledge of funds

free of charge

Pledge of bonds issued by the Bank

free of charge

Provision of statements on pledged property

10,000 in case of real estate property. 5,000 in case of moveable property

Revision of loan conditions

5,000 AMD

Correction/adjustment of the loan repayment operation (re-execution of the loan principal and/or interest repayment operation) once in a calendar year

Free of charge

Correction/adjustment of the loan repayment operation (re-execution of the loan principal and/or interest repayment operation) More than once in a calendar year

AMD 3,000

The Bank has all the necessary information security systems in place, thus keeping money on the account is secure. It is only necessary that the client also follows the security rules. In the meantime we hereby inform that the return of the funds available on the account in the amount of up to AMD 16 mln and amount in USD equivalent to AMD 7 mln is guaranteed in accordance with the RA law on "On Guarantee of Compensation for the Banking Deposits of Physical Entities".

The current account is opened for an indefinite term. Moreover, the account can be opened through the IDBanking.am online platform, Idram&IDBank mobile application and in the branches of the Bank for absolutely no charge.

The Bank opens and maintains current accounts in AMD, USD, EUR, RUB, British pound, Japanese yen, Swiss franc, Georgian lari, UAE dirham, Chinese yuan, Belarusian ruble.

No nondecreasing balance is applied to current accounts.

Both resident and non-resident entities can open current accounts.

Information bulletin of tariffs of bank accounts, transfers and other services provided by “ID Bank” CJSC for physical entities

Information bulletin of tariffs of bank accounts, transfers and other services provided by “ID Bank” CJSC for physical entities